Health insurance trends for 2024 show a common thread of the fact that we need to treat illnesses as a part of the whole, rather than in silos. Addressing all aspects of a person’s wellness can help ensure better health outcomes for all.

Key takeaways:

- Incidences of chronic diseases are on the rise as the workface ages, resulting in increased claims and secondary illnesses. At the same time, increased wait times and decreased access to care only make the situation worse, impacting treatment, and the claims experience of group benefits plans.

- Finances will continue to be a major driver of employee stress, as well employer decisions about their benefits plans. From inflation, high interest rates, the housing crisis, and more, employees are relying more on their benefits plans. At the same time, employers are wrestling with contrasting priorities of providing an attractive benefits plan while keeping costs contained.

- As employees and employers report being satisfied with their mental health offerings, look to see a slight slowdown in adding and communicating mental health benefits. Despite this, we also expect to continue seeing increased utilization of mental health supports.

- Communicating benefits has become a big topic of late – especially given the lack of understanding employees are “communicating”. Look to see more innovative, personalized benefits communication like reminders via push notifications that are tailored to the individual plan member.

- As AI is becoming a bigger part of our daily lives, it’s no surprise the group insurance industry is looking for ways it can be incorporated. Promising areas for use of AI include risk assessment and fraud detection. However, the progress on the client facing side may be slowed due to privacy and accuracy concerns.

Predicting industry trends is nothing new for us. Check out our previous years’ health insurance trends and predictions blog posts to see how the industry has changed over the past six years:

#1. Chronic diseases will have a big impact on the workforce

Chronic diseases, though they often represent a small portion of total claims, have a significant impact on benefits plans. Incidences of chronic diseases are on the rise as the workface ages, resulting in increased claims.

Since chronic diseases are ongoing illnesses (rather than acute), the costs for treatment are also ongoing. What’s more, many chronic diseases become exacerbated and lead to concurrent illnesses, such as declining mental health.

Prevalence and cost

Chronic diseases are increasing in both occurrence and overall cost.

The 2023 Benefits Canada Healthcare Survey (BCHS) reported that 54% of plan members are currently living with a chronic illness. Many chronic diseases are treated with high-cost drugs – such as inflammatory diseases like arthritis, respiratory illnesses such as asthma crones’ disease, and muscular diseases like multiple sclerosis. Although these drugs represent only 0.7% of the total number of claims, they represent 27% of the overall drug spend.

Comorbidities, increased wait times, and worsening conditions

The longer Canadians go without care, the worth their health outcomes get. Some may even develop comorbidities while waiting for treatment.

“A comorbidity is the presence of two or more medical conditions in a patient at the same time.” – Express Scripts 2023 drug trends report.

39% of people living with chronic pain reported having poor overall health, while 44% reported having poor mental health. Unfortunately, many Canadians will be waiting longer to access care, as it’s unlikely that healthcare wait times will improve in 2024 (more on that below). These declining conditions can lead to comorbidities and the worsening of conditions from curable diseases to permanent maladies.

Access to care

Lastly, Canadians’ ability to access treatment when they need it has declined significantly over the last 30 years, with steep declines since the pandemic. According to the Fraser Institute’s ongoing studies, the median wait time from physician referral to specialist treatment has risen by almost 200% since 1993, and today the average wait time is 27.4 weeks.

According to the Canadian Institute for health information, there are only 123 specialists per 100,000 Canadians, and only 2.5% of them live in rural areas. This creates an imbalance of care for Canadians in rural areas across the country.

With the rise in chronic diseases, as well as the further acceptance of obesity as a chronic disease, we believe employers will see this impact health insurance trends and therefore their benefits plans in 2024.

#2. Financial concerns will continue to be the biggest cause of employee stress

Many Canadians experienced economic uncertainty in 2023 with inflation on the rise and talks of a looming recession. Although Canada is expected to avoid a recession (barely), Canadians are struggling to make ends meet while saving for retirement, putting financial stress on many.

Inflation

Inflation was high in 2023, and although it has begun cooling off in the latter half of the year, its effects remain top of mind for Canadians, leaving them to wonder about what 2024 will bring.

“If inflation continues to rise, 87% of survey respondents anticipate day-to-day expenses becoming less affordable, 64% foresee an increase in debt, and 60% expect to delay their target retirement date.” – Benefits and Pension Monitor

At the same time, 51% of Canadians under age 35 agree they are living beyond their means. Even if inflation does level off, most employee salaries have not kept pace with the rise, which could leave many struggling to stay afloat, let alone save for retirement. Which brings us to…

Retirement savings

Employees are not optimistic about reaching their retirement goals. In fact, 63% expect to delay or alter their retirement by continuing to work part-time, or by switching jobs. Plus, findings from the HOOPP 2023 Canadian retirement survey saw 69% would prefer new or better pension benefits over a salary increase.

Interest rates, mortgage renewals and rental increases

Aside from inflation, Canadians are also dealing with higher interest rates. While this phenomenon has already impacted many, there are many more who have mortgages that will be coming up for renewal in the next few years. As the higher interest rates cause large increases in monthly mortgage payments, there are bound to be even more Canadians feeling increased monetary anxiety. The housing crisis has also caused undue financial stress for renters, with rental units costing an average of $2,149.

All of these financial stressors combined have created a sense of unease and nervousness when it comes to future financial security. Paying current bills, affording mortgages, saving for emergencies and retirement have all taken on a more urgent tone. It’s no wonder that 78% of HOOPP respondents believe that all employers have an obligation to help employees save for retirement. And that those who are unable to save for retirement will become a burden on future taxpayers.

Until inflation and interest rates settle or decrease, we expect to see financial concerns as the main cause of employee stress throughout 2024. This will likely affect other health insurance trends as utilization of services to combat stress goes up.

#3. Employers will not be immune to financial concerns

While employees struggle with their personal finances, employers are dealing with their own financial concerns. Businesses are not immune to inflation and interest rate hikes. The cost of doing business – in terms of people, supplies, services and logistics – has increased. Plus, business owners are not immune to rental increases either.

Coverage maximums

As with everything else, the cost of health care services and supplies has gone up. This means that amounts within current group benefits plans may no longer be sufficient. In fact, coverage maximums haven’t increased significantly in over 20 years, but plan costs have for both employees and employers.

For example, an employee who has been seeing their chiropractor for the past 7 years will find that the annual maximum under the plan has not increased, but the cost per treatment year over year has increased. The same holds true for dental coverage maximums, as well as amounts for eyeglasses, diabetic supplies, paramedical services, and more.

Reserves might help

There is a small silver lining here. The higher interest rates mean insurers’ reserves are able to keep up with the increase in disability claims. Reserves are an amount of money set aside by the insurer to pay the monthly benefit to a claimant for as long as the person is on disability and regardless of whether the group remains in force. It can also help with long-term disability rates, as the insurers are able to offset the increase in disability claims over the past few years with the income received from interest on the reserves.

Contrasting priorities

While employers try to keep benefit plan costs reasonable, they are also waging a war for talent which often demands increased salaries and better benefits.

The question, “how do employers provide higher coverage maximums while maintaining cost-containment?” will be a focus for the group insurance industry in the coming years. Look to see plan updates that include higher annual maximums and increased frequency limit amounts, while paring back unused benefits to keep costs reasonable. We also expect the continued health insurance trend of adding healthcare spending accounts to benefits plans to provide further coverage and flexibility.

#4. Mental health and wellness – the continuing saga

Employers have been listening to employees’ cries for more mental health services. There has been a paradigm shift in regard to mental health stigma, which has led to a higher focus on more support. Yet even though employees are asking for these services, are they using them? And if not, why?

Conflicting results and viewpoints

According to a Gallagher 2023 Canadian Workforce Trends Report, 75% of employers have increased their offerings for emotional wellbeing. While this sounds promising, only 35% of employees surveyed were satisfied with their insurer’s wellbeing initiatives.

At the same time, the 2023 BCHS found that 79% of employers were currently offering some kind of wellness program – with 61% of those specifically providing mental health services. The same survey said that 73% of plan members were satisfied with their workplace mental health support.

Yet a third study by Mental Health Research Canada found that only 40% of employees have access to assistance in coping with workplace stress, and 65% do not have access to programs that prevent employee burnout.

These differences in opinion could stem from variations in the way the questions were asked. However, it could indicate that some employees may not be aware of or understand the full suite of employee benefits that are being provided to them. More on that below.

The future of mental health and wellness support

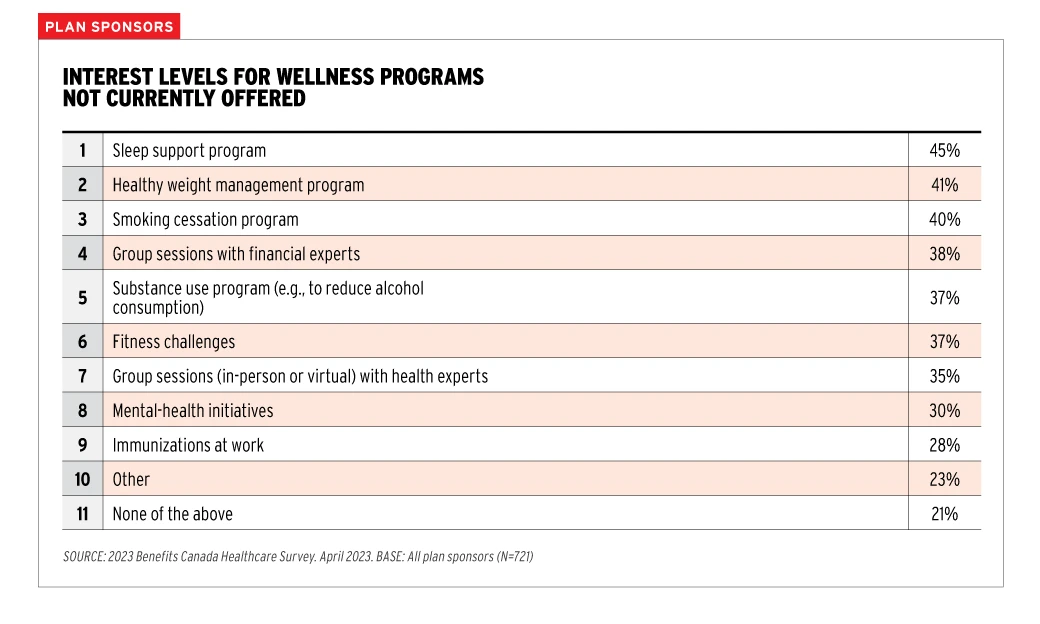

Compared to previous years, it appears that overall employee satisfaction with the wellbeing programs has gotten better. But there is still more that can be done, and plan sponsors seem to be willing to continue building. Again, the 2023 BCHS showed how plan sponsors are interested in new wellness program initiatives. And while less than a third were looking at adding mental health initiatives specifically, we believe this is due to many plan sponsors already offering mental health support.

“The advisory board cautioned against complacency in response to the positive results for a healthy work environment, which may be more a reflection of awareness rather than engagement in workplace wellness initiatives.” – 2023 BCHS

We predict there will be a slowdown in workplaces prioritizing employee mental health and wellness. As the shift in stigma continues, employers may see this as a sign that their employee benefits are hitting the mark. And if they are, we agree there is no reason to fix something that isn’t broken. We expect to see continued health insurance trend of wellness benefits utilization, as indicated by the continual rise in spending on mental health support year over year.

#5. Benefits communications will become more innovative

Employees don’t understand their benefits as much as they could or should. A fact that has been made clear from multiple sources. Notably, the 2023 BCHS reported that 49% of plan members understood their plan only somewhat well, not very well, or not at all. And while employers believe that email, printed booklets, and the insurer’s website was the best way to communicate benefits, employees disagreed. The same source found that employees’ preferred communication method was a website with resources and information they can access when needed.

Clearly some changes in the way we communicate employee benefits are needed. And given the fact that employee benefits are complex, it’s no wonder that employees only attempt to figure them out when the need arises. This can lead to misunderstandings in various forms, such as choosing a service provider who overcharges, not using a preferred pharmacy, or not submitting claims towards the deductible.

Navigation support and personalization

With more and more digital assistants, chatbots, and AI options appearing in everyday use, employees are anxious to receive similar support from their benefits providers.

The problem facing the group insurance industry is that there is so much sensitive medical information that could be exposed, that it must tread cautiously. However, there is an opportunity to help by answering common questions, and by updating live telephone support to live online chat support.

There is also a way to set up common workflows which set employees along a navigation path once they have reached a certain step in their benefits understanding journey.

Regular touchpoints

Employee benefits are usually communicated during onboarding, and at best annually afterwards, which may be enough for employees who have a strong grasp of how they work. But for employees who don’t regularly use their benefits, a quick refresher in-person can go a long way. Not only can it provide much needed clarity on functionality and use, but it can be a great retention tool.

The benefits of face-to-face communication can’t be understated:

![“AI has a hard time displaying empathy like a human. [Chris Chan] pointed to health research showing that patients responded better to health messages received on a pager when they knew a person sent them rather than a machine.”

– Kathy Bergstrom, CEBS](https://www.bbd.ca/wp-content/uploads/2023/11/TR-blog-quotes5-1024x256.png)

“AI has a hard time displaying empathy like a human. [Chris Chan] pointed to health research showing that patients responded better to health messages received on a pager when they knew a person sent them rather than a machine.” – Kathy Bergstrom, CEBS

Medication reminders based on previous claiming history

Insurers have a unique ability to access a plan members’ claiming history. Using this, they could potentially send personalized messages directly to the plan member based on previous claims and medical history. These push notifications could include reminders for things such as:

- prescription refills

- eye exams

- diabetic supply restocking

- Diagnostic tests required by age or medical history (example: mammogram at age 40)

- Dental cleanings and check-ups

- And more!

As the world becomes increasingly more dependent on technology, it will surely help us communicate group benefits in a more personal, concise, and easy-to-understand way.

#6. Artificial Intelligence will be incorporated to some degree

Many of the communication and navigation support suggestions above could benefit from the use of Artificial intelligence (AI). The main concerns are centered around accuracy and confidentiality.

In terms of confidentiality, it’s pretty obvious what the issue is. Especially where open source AIs like ChatGPT are concerned, there is zero privacy. Which means it would be inadvisable to enter your or anyone else’s health information, medical history, or the like into the program, as it then becomes public. Other AI options might be more secure, but generally, any open AI programs will not be able to offer you any privacy protection.

Regarding accuracy, AI is not always correct. Even if the AI program is originally fed the correct information, mistakes happen, and the AI could inadvertently learn the wrong thing. For instance, one program designed to detect skin cancer erroneously learned that a ruler was a precursor to having skin cancer, due to being fed thousands of photos of skin cancer that included rulers to show scale.

However, there may be more of an opportunity behind the scenes: the integration of AI into application development and maintenance. We also expect to see more use of AI for data analytics, benefits fraud detection, and risk management.

“AI is no longer confined to science fiction; it’s becoming an essential part of the tools we use in software development. It was predicted that by 2024, 65% of application development would be done with low-code/no-code tools.” Noel Memije – Director of Development at Benefits by Design

The group insurance industry is an ever-evolving landscape, with many moving parts. Each health insurance trend influences the others, just as each part of a person’s health affects their overall health. We’ll be watching closely – as always – to see how these predictions shape up in the coming year.

Borrowed from BBD.ca blog_https://www.bbd.ca/blog/health-insurance-trends-and-predictions-2024/